The Winning Guide to Venue Pricing: What Every NYC Venue Owner Needs to Know

As with any active market, pricing benchmarks should be reviewed every 6 to 12 months to ensure they continue to reflect demand, costs, and booking behavior.

Pricing an event space in New York City isn’t about picking a number that sounds reasonable. It’s about revenue strategy.

The event venue industry has a high barrier to entry, largely because of capital. Based on Tagvenue data, startup costs for event venues typically range between $50,000 and $150,000, driven by real estate, licensing, staffing, and setup costs, especially in desirable NYC locations. Once operational, however, there’s effectively no ceiling on what a venue can earn if pricing, positioning, and demand are aligned.

On average, venue owners take home 10–20% profit, while high-demand venues in strong locations can reach margins of 40–60%. In New York, the difference between average and exceptional performance is rarely décor or square footage, it’s how the space is priced, packaged, and sold.

Pricing mistakes are amplified in NYC:

- Underprice, and you quietly lose thousands in missed revenue.

- Overprice, and enquiries disappear instantly in a city with endless alternatives.

This guide explains how NYC event pricing actually works, what drives rates up or down, and how to build a pricing structure that protects margin without slowing bookings.

Here’s a practical, straight-to-the-point checklist covering costs, pricing models, transparency, and dynamic pricing, designed specifically for NYC venues.

Tired of looking up for venue data?

On Tagvenue, you can compare pricing structure for venues like yours and gain visibility to boost sales.

- How Venue Pricing Works in NYC

- Start With Revenue Logic, Not Venue Type

- Location in NYC: Pricing Is Really About Opportunity Cost

- Event Space Costs in NYC: Realistic Benchmarks (2026)

- Capacity, Duration & Operational Pressure Matter More Than Size

- Transparency: Why Clear Pricing Converts Faster

- What Every NYC Venue Pricing Template Should Include

- Common Pricing Mistakes NYC Venues Should Avoid

- Dynamic Pricing in NYC: How Smart Venues Maximise Revenue

- Using Packages Strategically (Without Discounting Yourself)

- Borough Pricing Logic

- Profitability by Venue Type

- How to Review and Adjust Your Pricing

- How Tagvenue Supports Pricing, Marketing & Selling

- Final Thoughts

How Venue Pricing Works in NYC

New York isn’t one market, it’s dozens of micro-markets operating side by side. Pricing is shaped by:

- extremely high venue density

- strong weekday and corporate demand

- sharp differences between neighbourhoods

- a wide range of event types competing for the same dates

As a result, successful NYC venues rarely rely on a single, static pricing approach. Instead, pricing shifts based on who is booking, when they’re booking, and what revenue that booking replaces.

This is why copying a competitor’s rate card rarely works. Two venues can look similar online and still require completely different pricing logic behind the scenes.

Platforms like Tagvenue help surface how comparable venues price their spaces, so decisions are grounded in market reality rather than guesswork.

Start With Revenue Logic, Not Venue Type

One of the most common pricing mistakes venue owners make is pricing purely by category: bar, restaurant, wedding venue, meeting room, and so on.

In NYC, pricing works best when it’s based on how the space earns money during an event, not just what the space is called.

The Three Revenue Models That Matter Most

| Revenue Mode | Common Venue Types | How Revenue Is Generated | Best-Fit Pricing Models |

| Spend-driven | Bars, restaurants, lounges | Guest spend over time | Minimum spend, hybrid |

| Time-driven | Meeting rooms, studios | Time booked | Hourly, half-day, day rates |

| Experience-driven | Weddings, milestone venues | Certainty & experience | Flat fees, packages, per-person |

This framework helps avoid underpricing simply because a venue fits a familiar label. A restaurant hosting a Saturday night buyout should not be priced like a weekday meeting room, even if the room itself is identical.

Location in NYC: Pricing Is Really About Opportunity Cost

Location affects pricing everywhere, but in NYC, it directly determines what you’re giving up by hosting a private event.

| Area | Pricing Pressure | Why |

| Manhattan | Very high | Events often replace strong walk-in or corporate revenue |

| Brooklyn | Variable | Weddings and social events perform well; seasonality matters |

| Other boroughs | More flexible | Pricing driven by accessibility and repeat local demand |

In NYC, a four-hour Friday evening booking often displaces lucrative dinner service, bar revenue, or multiple smaller turns, necessitating higher pricing for peak evenings, weekends, and full buyouts versus quieter weekday or daytime slots.

Weekend/evening events frequently carry 20-50% premiums or more over weekdays.

Full buyouts or peak Friday/Saturday nights often demand significantly higher minimum spends ($16,000–$30,000+ for restaurants/bars) versus weekday or daytime equivalents ($6,000–$15,000 range in many cases).

Off-peak (weekdays, afternoons) offers discounts to fill capacity, while peak times reflect lost revenue potential from regular operations.

Event Space Costs in NYC: Realistic Benchmarks (2026)

While pricing varies widely, most NYC venues fall into predictable ranges.

Typical Hourly Rates by Venue Type

| Venue Type | Typical Hourly Range |

| Community & basic spaces | $50–$175 |

| Mid-range event spaces | $175–$550 |

| Banquet halls & hotels | $600–$1,800 |

| Luxury, rooftop, exclusive venues | $1,800–$5,500+ |

Minimum booking durations (3–5 hours) are common and significantly impact total revenue.

Flat Event Pricing (Instead of Hourly)

Flat pricing is increasingly popular in NYC because it reduces negotiation friction and aligns better with experience-driven bookings.

| Venue Type | Typical Flat Event Pricing | Best Use Case |

| Bars & Pubs | $1,500-$6,000 | Evening buyouts, social events |

| Restaurants | $2,000-$8,000 | Dining-led partial or full buyouts |

| Meeting Rooms | $500-$3,000 | Half-day / full-day corporate bookings |

| Mid-size Banquet Halls | $3,000-$8,000 | Weddings, milestone events |

| Wedding Venues (avg.) | ~$13,000 | Full-day, experience-driven |

| Luxury Wedding Venues | $18,000-$45,000 | Premium dates & demand |

Flat pricing works particularly well when your clients value certainty more than flexibility.

Done scrolling through NYC venue prices?

Optimize yours to attract more inquiries from local planners and corporate clients. Turn more leads into confirmed events.

Capacity, Duration & Operational Pressure Matter More Than Size

In NYC, capacity alone rarely determines price.

What matters more is:

- how long the space is blocked

- whether walk-in trade is restricted

- how much staffing and coordination the event requires

| Guest Count | Typical Total Pricing |

| 20-75 guests | $200–$2,000 |

| 76-200 guests | $2,500–$8,000 |

| 200+ guests | $5,000–$25,000+ |

A 40-person weekday meeting and a 40-person Saturday night party may require completely different pricing, even in the same room.

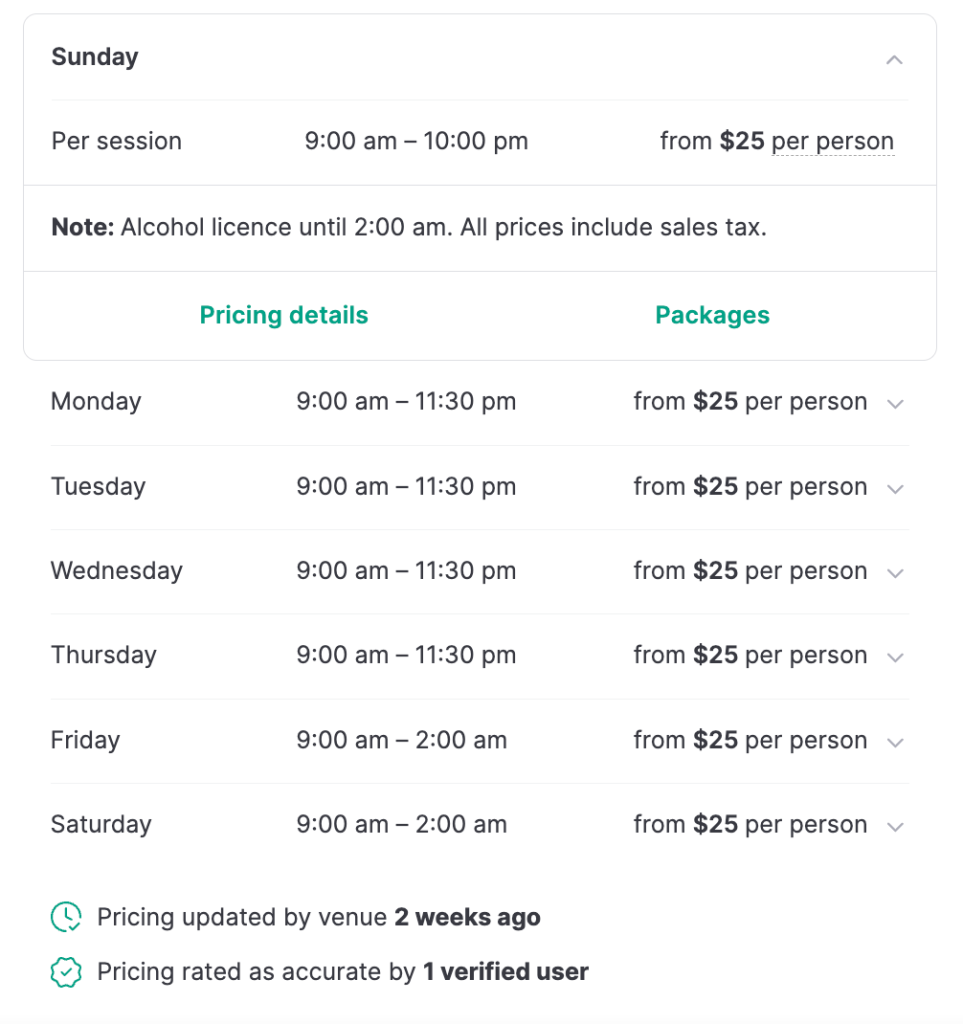

Transparency: Why Clear Pricing Converts Faster

Hidden fees don’t just frustrate planners, they slow bookings and create unnecessary stress.

Common charges that cause friction include:

- service charges (15–23%)

- minimum spend requirements

- setup and breakdown fees

- security and staffing

- AV, Wi-Fi, equipment

- peak-season surcharges

Venues that clearly show what’s included vs. what’s extra tend to attract better-fit enquiries and close faster.

Lack of transparency is also one of the most common complaints raised in Reddit communities discussing event planning and venue hire. Unexpected fees or unclear pricing structures frequently lead to distrust and drop-offs. Clear, upfront pricing helps venues attract more qualified enquiries and reduce back-and-forth.

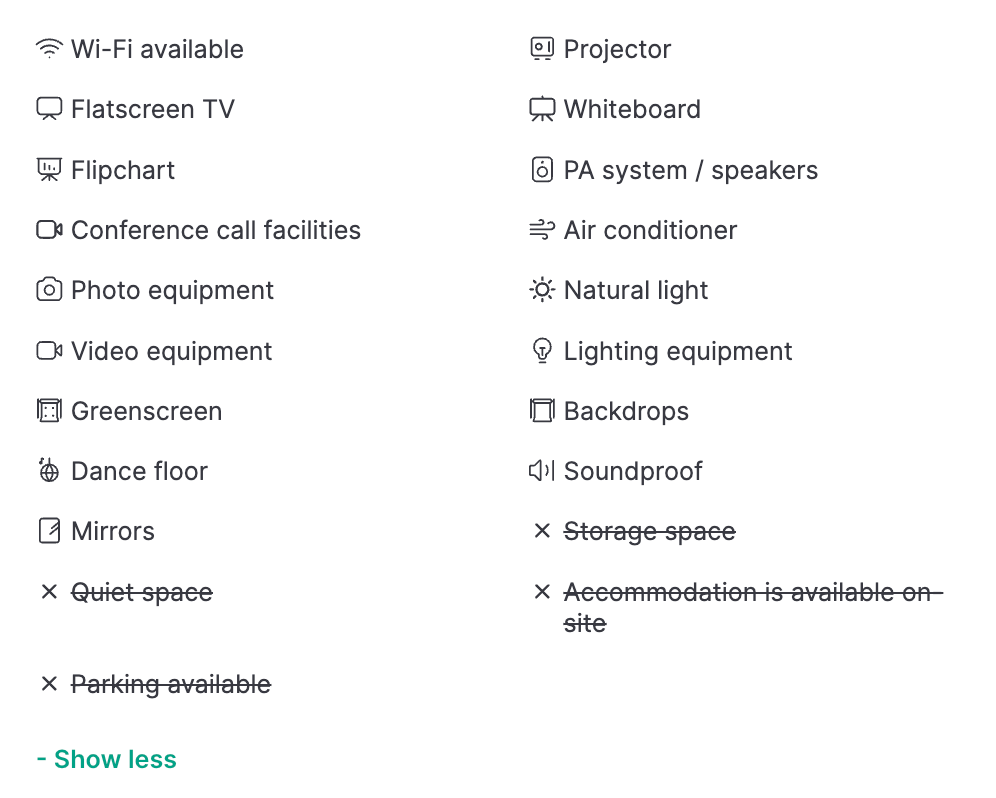

What Every NYC Venue Pricing Template Should Include

A strong pricing structure answers most questions before the first reply.

NYC pricing essentials:

- pricing model (hire fee, minimum spend, per-person, hybrid)

- minimum hours and overtime rules

- what’s included (furniture, AV, staffing, setup)

- peak vs off-peak pricing

- deposit and cancellation policy

- clear add-ons list

Venues with clear pricing structures consistently receive more qualified enquiries because planners can immediately tell whether the venue fits their needs and budget.

Common Pricing Mistakes NYC Venues Should Avoid

- Underpricing out of fear: Many owners lowball rates to fill calendars quickly, especially post-slow periods, but this erodes perceived value and leaves money on the table in a market where planners expect premium pricing for prime locations.

- Ignoring displacement cost: A peak-time booking (e.g., Friday evening buyout) often replaces high-volume dinner service, bar sales, or multiple smaller turns, failing to factor this lost revenue leads to undercharging for high-demand slots.

- Overcomplicating pricing: Too many tiers, add-ons, or unclear structures confuse clients and slow decisions. Simple, transparent models with clear minimums or packages convert faster in busy NYC searches.

- Not reviewing rates regularly: With inflation, rising labor/food costs, and shifting demand in 2026, sticking to outdated pricing misses opportunities. Review quarterly against competitors on Tagvenue and adjust for seasonality.

- Charging the same for peak and off-peak: Uniform rates ignore NYC realities. For instance, evenings/weekends command 20–50%+ premiums due to higher opportunity costs. Dynamic pricing fills off-peak slots while maximizing peak revenue.

- Overlooking hidden fees or add-ons in quotes: Not transparently including or communicating extras like overtime, cleaning, AV, setup, or gratuities leads to client surprises, bad reviews, and lost repeat business. Always break it down upfront or include it in your venue listing details.

- Failing to account for minimum spends vs. actual capacity — Setting minimums too low for large groups risks under-recovering costs; align them with realistic per-guest spend to avoid subsidizing big events.

The most successful venues revisit pricing often and adjust based on performance, not instinct.

Dynamic Pricing in NYC: How Smart Venues Maximise Revenue

Dynamic pricing isn’t about constant changes — it’s about aligning rates with demand.

Key levers include:

- seasonality

- day of week

- time of day

- lead time

- event type

NYC venues that use dynamic pricing note that they don’t necessarily book more events — they earn more per event.

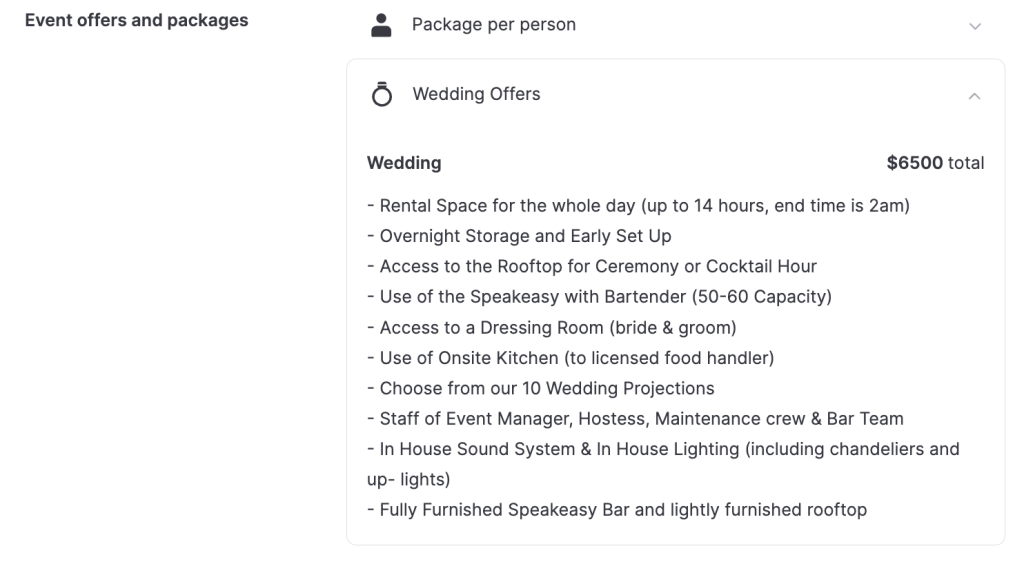

Using Packages Strategically (Without Discounting Yourself)

In a fast-moving market like New York, packages reduce friction and speed up decisions.

Packages perform best when:

- Demand is time-sensitive

- Clients want clarity over flexibility

- Venues want predictable revenue

Strong packages bundle structure and certainty:

- fixed duration

- clear inclusions

- predictable staffing

Borough Pricing Logic

Event pricing in New York City varies significantly by borough, driven by differences in demand, accessibility, and the type of events each area attracts. While Manhattan often commands firmer pricing due to opportunity cost and corporate demand, other boroughs allow for more flexibility and value-driven pricing. Understanding these dynamics helps venues align their rates with realistic revenue potential rather than applying a one-size-fits-all approach.

| Borough | Pricing Characteristics |

| Manhattan | Firmer pricing, strong weekday demand |

| Brooklyn | Wide range, strong weddings & socials |

| Queens | Value-driven, accessibility matters |

| Bronx | Community-driven, repeat local bookings |

| Staten Island | Destination events, full-day pricing |

Profitability by Venue Type

Not all venue types generate revenue in the same way. Profitability depends on how events are priced, how long spaces are occupied, and how much operational effort each booking requires. The table below highlights how different venue types typically perform in New York City, based on demand patterns and pricing structures rather than size or aesthetics alone.

| Venue Type | Profit Potential | Why |

| Wedding Venues | Very high | High tolerance for flat fees |

| Restaurants | High (when optimised) | Spend-driven upsid |

| Bars & Clubs | Medium-high | Volume + minimum spend |

| Conference Venues | Medium | Predictable, capped upside |

| Community Spaces | Lower | Price-sensitive demand |

How to Review and Adjust Your Pricing

Pricing should evolve as your venue’s demand and performance change. Rather than relying on intuition, review how your space performs across different dates, times, and event types.

If enquiries are frequent but rarely convert, pricing or structure may need adjustment.

Tracking patterns such as lead time and peak-date demand helps venues refine pricing gradually, without disrupting bookings. The most successful NYC venues treat pricing as an ongoing process, revisiting it regularly rather than locking rates in for long periods.

Watch for:

- Dates filling too fast

- Lots of enquiries but low conversion

- Frequent negotiation

- Repeated event types

Patterns reveal when pricing needs adjustment.

How Tagvenue Supports Pricing, Marketing & Selling

Clear pricing structures, packages, and inclusions help attract better-fit enquiries and reduce back-and-forth during the booking process. Beyond pricing, Tagvenue helps venues market their space more effectively through detailed listings, search filters, and structured offers. This allows venue owners to focus on optimising revenue and operations, while the platform supports discovery, comparison, and conversion.

Tagvenue supports venue pricing by:

- Increasing exposure

- Surfacing comparable market pricing

- Reducing friction through clarity

- Attracting better-fit enquiries

Final Thoughts

In New York City, pricing isn’t a one-time decision but a core operational strategy. The best-performing venues aren’t the cheapest or the flashiest; they’re the ones whose pricing smartly reflects:

- how their space actually earns money,

- what each booking displaces or replaces,

- and what clients genuinely value.

When pricing is clear, justified, and aligned with real demand, bookings come naturally, no race to the bottom required.

Get your NYC venue discovered by event planners

Set smart, competitive pricing on Tagvenue, benchmark against top Manhattan and Brooklyn venues, list for free, and watch bookings and profits soar.